Various Sum Insured options from 3-7.5 lakhs + Restore benefit to auto-reinstate your sum insured + Loyalty Perk from 10% to 100% every claim free year+ No reduction in unutilized Loyalty Perk.

Various Sum Insured options from 2-10 lakhs + Loyalty Perk from 10% to 100% every claim free year + No reduction in unutilized Loyalty Perk at renewal if claims under the policy+ Daily cash of Rs. 500/-

Various Sum Insured options from 3-15 lakhs + Restore benefit to auto-reinstate your sum insured + Loyalty Perk from 10% to 100% every claim free year + No reduction in unutilized Loyalty Perk at renewal.

Various Sum Insured options from 2-15 lakhs + Restore benefit to auto-reinstate your sum insured + Loyalty Perk from 10% to 100% every claim free year + No reduction in unutilized Loyalty Perk...

UIN : LIBHLIP21500V032021

₹3,4,5,7.5 Lakhs

₹2,3,4,5,6,7.5,10 Lakhs

₹3,4,5,6,7.5,10,15 Lakhs

₹2,3,4,5,6,7.5,10,15 Lakhs

Liberty General Insurance Limited (LGI) is a joint venture between the Liberty General Insurance Industries Limited and Liberty City State Holdings PTE Ltd, a group company of US based Liberty Mutual Group, a leading global property and casualty group. Liberty Mutual Group, a leading global property and casualty group.

Liberty Mutual Insurance Group was founded in the year 1912 and now is a diversified global insurer and has over 900 offices over the world. With Liberty Mutual's 100 years of supervision in the insurance industry globally, Liberty General Insurance Limited is here with a vision to build a customer centric business to address the distinct needs of individual and corporate customers.

Health insurance will protect you and your family against any financial contingency arising due to a medical emergency.

Your employer will cover your medical expenses only as long as you are in his services. Tomorrow, you may change your job, retire, or even start something on your own. In all such cases you and your family will be stranded if a medical emergency arises and you have not arranged for an alternative health insurance policy. It is at this point of time that Health Insurance policy will come to your rescue.

Health Insurance policy can also act as a supplement to your existing medical cover in case the cost of medical treatment is higher than your existing cover level.

We offer both, individual and Family Floater policies.

Liberty Health connect policy is open to individuals from the age of 91 days to 65 years.

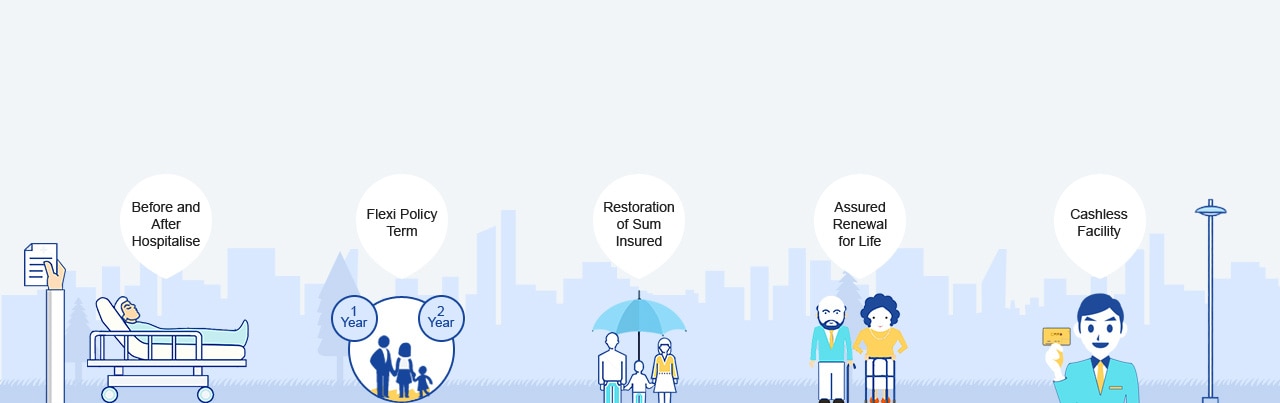

Liberty General Insurance offers policies with option of 1 year and 2 years policy period which can be renewed after that.

Medical examination may be required in some cases, based on the sum insured and the age of the person.

No, if the insured renews the policy continuously without a break and there is no change in the policy terms and conditions.

The proposed member has to pay for the cost of Pre-Policy Check-up (PPC). We will co-ordinate the appointment with our empanelled doctor and/ or diagnostic centre through our appointed TPA. On acceptance of your application and subsequent issuance of the policy, 100% or 50% of the expenses incurred per insured person will be reimbursed; depending upon the age and Sum Insured opted.

Family Floater policy is a policy wherein the entire family of the insured comprising of insured and his / her dependents are covered under single sum insured. The sum insured for a family floater is our maximum liability for any and all claims made by all the insured members. :

The advantages of such a policy are:

You can enroll total of 4 members under family floater policy as per the following family definitions

Q 12. You can buy this policy for yourself, your spouse, your dependent children; above the age of 91 days up to 25 years, your dependent parents or parents-in-law up to the age of 65 years.

A Medical Practitioner (physician, specialist or surgeon) is a person who holds a valid registration from the medical council of any state or Medical council of India or Council for Indian Medicine or for Homeopathy set up by the Government of India or a State Government and is thereby entitled to practice medicine within its jurisdiction, and is acting within the scope and jurisdiction of his license, provided that this person is not a member of the Insured Person’s family.

Pre- and Post-hospitalization expenses cover all medical expenses incurred within 30 or 60 days (depending upon the plan chosen) prior to hospitalization and expenses incurred within 60 or 90 days (depending upon the plan chosen) post hospitalization provided the expenses were incurred for the same condition for which the Insured Person’s hospitalisation was required.

Medical expenses, means all those reasonable and medically necessary expenses that an Insured Person has necessarily and actually incurred for medical treatment during the policy period on the advice of a medical practitioner due to illness or accident occurring during the policy period, as long as these are no more than would have been payable if the Insured Person had not been insured and no more than other hospitals or doctors in the same locality would have charged for the same medical treatment.

By Pre-existing Condition we mean any condition, ailment or injury or related condition(s) for which you had signs or symptoms, and / or were diagnosed, and / or received medical advice/ treatment, within 48 months prior to the first policy issued by the insurer

The expenses or benefits can be claimed or indemnified by reimbursement or by availing cashless services at the empanelled hospitals by Us.

The cashless facilities are available only at the hospitals which are in our network.

When you are admitted to the network hospital, you need to show the Liberty Health Connect Health Card along with any photo ID Proof to the treating doctor. The Network Hospital would contact the responsible TPA (Third Party Administrator, mentioned on the card) and fill up the pre-authorization form. Then it would send the same to TPA with estimation of expenses. The TPA checks the policy conditions and the sum insured and approves the estimate.

Health card lets you enjoy the benefits of Cashless facility provided by the policy. It also serves you as an identity card in the event of any unforeseen accident to the third party and helps them in arranging necessary emergency treatment

Yes, we will pay the entire admissible amount for the medical expenses incurred subject to the sum insured. You might have to pay for the non-medical and expenses not covered to the hospital prior to your discharge from hospital.

The cheques are sent to the hospital to whom approvals for cashless are given.

Deductible means a cost-sharing requirement under a health insurance policy that provides that the Insurer will not be liable for a specified rupee amount in case of indemnity policies and for a specified number of days/ hours in case of hospital cash policies which will apply before any benefits are payable by the insurer. A deductible does not reduce the Sum Insured

Grace Period means the specified period of time immediately following the premium due date during which a payment can be made to renew or continue a policy in force without loss of continuity benefits such as waiting periods and coverage of pre-existing diseases. Coverage is not available for the period for which no premium is received

After purchasing the Policy, in case you find it unsuitable to your needs, you can, within a free look period of 15 days from the receipt of the policy, request for a cancellation of the Policy

Vipul MedCorp TPA Pvt. Ltd. is our appointed TPA.

Vipul MedCorp TPA Pvt. Ltd, a company promoted by Vipul group is engaged in the managed healthcare facilitation & has obtained a license from IRDA for TPA activities (Health) and offers its clients a wide array of services

The claim documents should be submitted to the TPA, mentioned on your health card(s).

A waiting period is the length of time the insured have to wait before being eligible for specific Health Policy benefits

Liberty Health connect policy offers optimum health coverage at an affordable price.

The plan not only covers hospitalisation expenses due to accidents or illness but extends to cover pre and post hospitalisation expenses, day care procedures, domiciliary treatment, organ donor expenses, emergency ambulance, nursing allowance, recovery benefit, restoration of Sum Insured and Extended policy tenure benefits.

You can choose from four variants as mentioned below with Sum Insured ranging from Rs. 2 lakh, and 15 lakh:

1. Family Discount - The policy provides a Family discount of 10%, if 2 or more family members are covered under a single policy on Individual Sum Insured basis.

2. Multi-year Policy Discount - The policy provides a Multi – year policy discount of 7.5%, if the insured opts for 2 year policy term

Extension of the Policy tenure is one of the benefits of Liberty Health Connect policy. In case you are travelling out of the country with a travel policy form Us, we will extend your Health Connect policy tenure to the extent of number of days you are out of the country at no additional cost.

Yes, the premium paid for health insurance policies qualifies for deduction under Section 80D of the Income Tax Act.

. An amount of up to Rs. 15,000 of premium paid for self, spouse and children are exempted.

. Additional deduction of Rs. 15,000 for covering parents is allowed, and if parents are Senior Citizens, aged 65 years or more then the exemption increases upto Rs. 20,000.

. The health insurance premium that you pay must be from the taxable income applicable for the year you claim.

If for any reason you wish to opt out of the Insurance, the premium for the period at risk shall be retained as per the short period rates and balance shall be refunded. No refund shall happen on policies where a claim is notified or settled. Please refer to our detailed Policy Wordings for more information on this.

You can contact us through our toll free number 1800-266-5844 or Write to us at care@libertyinsurance.in or Visit our nearest branch (for list of branches visit http://www.libertyinsurance.in/contact-us).

Thanks Mr. Kaushal and Mr. Rajesh Portability for Mr. Rohit's son is accepted by Health Insurance Underwriting Team. This is a lovely example of ''OUT OF THE BOX'' thinking at LVGI as Dr. Liji has physically examined the boy after discussing the matter with Dr. Asha and Hemlata madam instead of compelling him to go for X-Ray/MRI. Parents of the boy appreciated the way proposal was tackled as parents and the consulting doctor were not of the opinion of taking X-Ray/MRI of the young boy, as he was fit post hospitalization. Thanks to Underwriting Team for thinking differently.

Sir

We have received the transferred amount.Thanks a lot for paying heed to our matter.

We will always remain grateful to you for your kind gesture.

"Thank you very much" to Rima Malhotra for your support and help

I just want to say, I was impressed by your work what you did. your quick response and you kept following my refund request of excess amount till to its complete.

Really I liked your service from your company and hereby I confirm that finally I got my refund (credited to my account) today. Thanks once again

"I am very happy for the customer care services. Whenever I wrote or called I got quick and appropriate reply. Thank you very much for your response. I hope you would continue doing good work

Liberty Mutual Insurance Group Announces

New Joint Venture Partnership for Indian

Company

Chances are that you are among a large number of people who forget to renew their vehicle insurance ....

Registration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656

2019 Liberty General Insurance Ltd.

Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013

Trade Logo displayed above belongs to Liberty Mutual and used by the Liberty General Insurance Limited under license. For more details on risk factors, terms & conditions please read sales brochure carefully before concluding a sale.