If you are worried about the growing risk of infectious diseases and lifestyle-related illnesses, and the rapidly rising cost of medical treatment, then you need to consider our HealthPrime Connect Essential Plan.

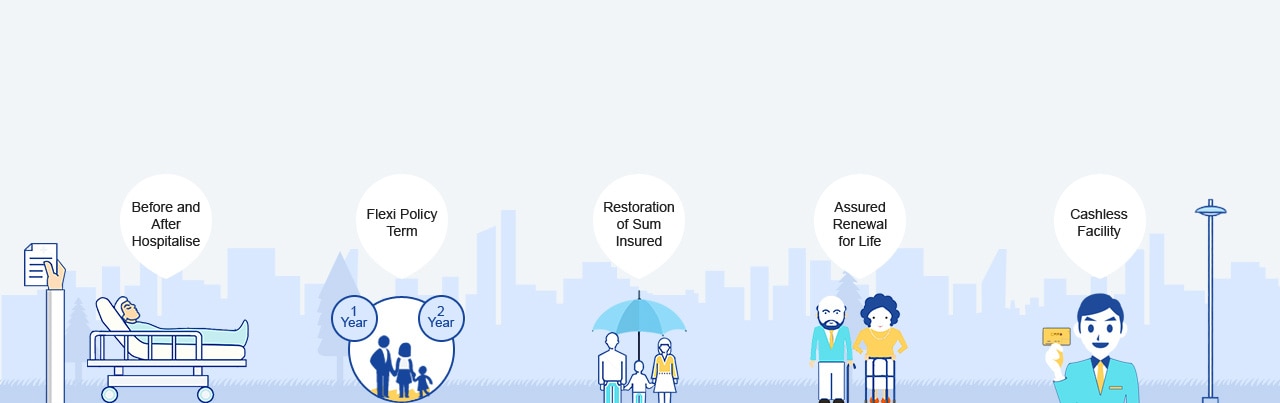

The comprehensive policy provides financial protection when you need it most – when you or your family require medical treatment. The plan packs a wealth of features and benefits into one compelling package, including financial cover from Rs 10 lakh to Rs 50 lakh, pre- and post-hospitalisation, no copay or sub-limits, claim-free bonuses and lifestyle and renewal benefits.

Inpatient treatment (> 24 hours) and daycare treatment (< 24 hours) and Pre- and post-hospitalisation: 60 days pre and 90 days post

Hospital Daily Cash: Rs 1000 per day max up to 10th day of continuous Hospitalization and Ambulance charges: Rs 2500

Second opinion & Screening and treatment of organ donor (up to Sum Insured)

1. Sum Insured:

2. Expenses covered:

3. Allowances:

4. Special Expenses:

5. Wellness benefits:

6. Restoration benefits:

7. Emergency assistance while you are 150-km away from your permanent residence

8. Renewal Benefits:

Entry age: Minimum is 18 years and maximum 65. Children between 91 days and 25 years can be covered as dependents

Yes, based on your needs, you can opt for an individual or floater plan.

In an individual plan, you can cover yourself, your spouse, children, parents, siblings, son-in-law, daughter-in-law, parents-in-law, grandchildren and grandparents. If you choose to cover more than two members, you are eligible for a 10% discount.

In a floater plan, you can cover a maximum of two adults and three children.

You can opt for cover ranging from Rs 10 lakh to Rs Rs 50 lakh based on your needs.

No. The Essential Plan has no copay and no sub-limits.

Yes, you can pay the premium in easy instalments half-yearly in two instalments, quarterly in four instalments or monthly in 12 instalments.

No. Optional worldwide coverage is available with Optimum and Optimum plus plans.

Yes, but only after 48 months of continuous coverage

Claims are processed by a dedicated in-house team. You can read about our claim process here.

Disclaimer:

Product Name:-HealthPrime Connect - Essential Plan - Liberty General Insurance Limited , Product UIN: LIBHLIP19050V011920.

HealthPrime Connect - Optimum: A comprehensive policy that gives you the perfect mix of coverage and benefits.

You are an achiever who will not settle for second best in anything. Naturally, when it comes to matters of health, you will brook no short-cuts or compromises.

Average RatingBased on 35 Ratings

Liberty General Insurance offers the best health insurance in India. The plans available with the company are so many...

If you are looking for the best health insurance plans in India, I suggest you go for Liberty General Insurance ...

Liberty offers the best health insurance policy in the market in terms of coverage. I did a very thorough...

I was looking for a health policy that would provide coverage for at least 2 years, so that I wouldn’t have to renew...

I wanted an extra health insurance plan, as the insurance cover from my employer wasn’t enough. I looked at a...

Motor insurance covers several type of vehicle including two, three, and four wheelers. Typical Motor Insurance Policies...

In India, medical costs are increasing at the rate of 15-20%. Unhealthy lifestyle habits and an increasing number of diseases are further adding...

Read More

Getting a health insurance for yourself and your family is as important as adopting a healthy lifestyle. Buying a health insurance cover is...

Read More

By now, most of us know that health insurance provides coverage against expenditure caused by a medical emergency. With rising medical care...

Read More

When you are young and healthy, it is common for people to believe that they are fine and won't require any medical attention, at least not ...

Read MoreRegistration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656

2019 Liberty General Insurance Ltd.

Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013

Trade Logo displayed above belongs to Liberty Mutual and used by the Liberty General Insurance Limited under license. For more details on risk factors, terms & conditions please read sales brochure carefully before concluding a sale.